Which of the Following Statements Accurately Describes Depreciation

Course Title ACCTG 201. Solved Expert Answer to Which of the following statements accurately describes depreciation.

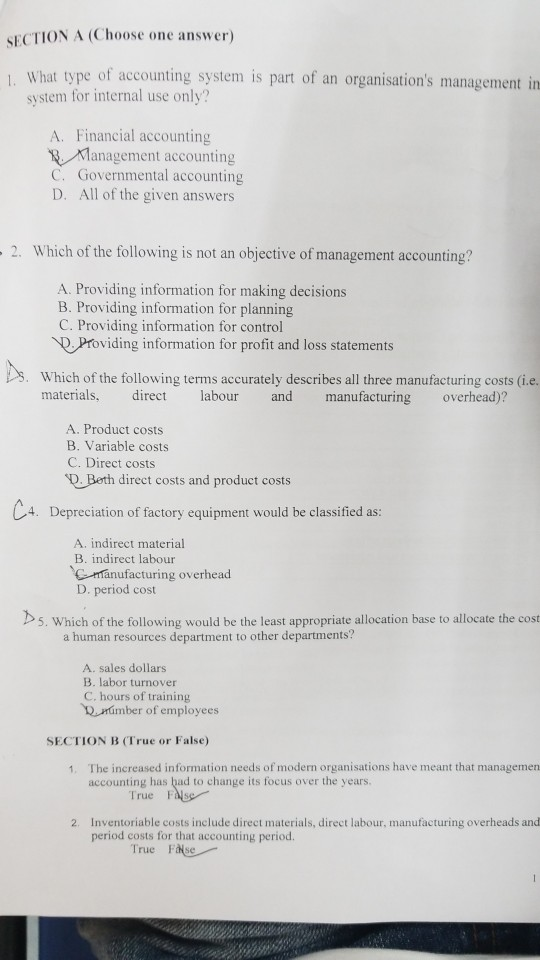

Solved Section A Choose One Answer 1 Wh At Type Of Chegg Com

Get Best Price Guarantee.

. Gave the choice of one set or two or more sets of consolidated accounts. The book value of an asset is its original cost less accumulated depreciation. My professor states that the answer is D but why.

Depreciation is used to track the fair value of the asset. The book value of an asset is. Depreciation allocates the cost of an asset over periods benefited.

Accumulated depreciation is a contra asset with a debit balance B. Which of the following statements accurately describes depreciation. The reasons for depreciation might be due to various reasons like poor maintenance and service etc.

Depreciation is used to track the fair value of the asset. Which of the following statements accurately describes depreciation. Depreciation is used to track the fair value of the asset.

Depreciation is used to track the fair value of the asset. Gave the choice of using full consideration proportional consolidation or the equity method of accounting. This preview shows page 16 - 18 out of 18 pagespreview shows page 16 - 18 out of 18 pages.

Which of the following statements accurately. The original cost of an asset minus its estimated residual value at the end of its service life. Option C describes sale and option D describes increase in rise of the product.

Accumulated depreciation is a contra asset with a debit balance. Depreciation is the process of allocating the cost of the asset over periods benefited. School San Diego State University.

Option A decribes the same decrease in price or value over time. Which of the following statements accurately. Depreciation cost in the earlier years and lower charges in.

Depreciation is used to allocate the cost of the asset over periods benefited. A Depreciation is used to allocate the cost of the asset over periods benefited B Depreciation is used to track the fair value of the asset C The book value of an asset is its original cost less accumulated depreciation D Two of the above are correct E All of the above are correct. Ratings 100 1 1 out of 1 people found this document helpful.

Depreciation is the process of allocating the cost of the asset over periods benefited. Depreciation is defined as the reduction in value of an asset with the passage of time. Accumulated depreciation is a contra asset with a debit balance B.

Which of the following statements accurately describes the elimination entry to. Or a combination. Which of the following statements accurately describes depreciation.

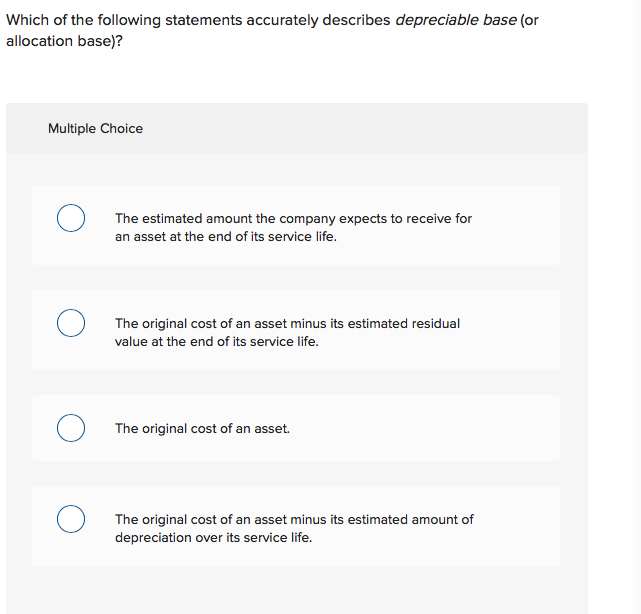

The book value of an asset is its original cost less accumulated depreciation. Which of the following statements accurately describes depreciation. Multiple Choice The estimated amount the company expects to receive for an asset at the end of its service life.

A depreciation method which provides for a higher. Which of the following statements accurately describes depreciable base or allocation base. Which of the following statements accurately describes depreciation Selected.

All of the above are correct. A the quotient x-2 and x29 B the product x-2 and x29 C the quotient x29 and x-2. All of the above are correct.

All of these statements are correct. Annual depreciation amount over the useful life of the asset. Depreciaion is used to allocate the cost of the asset over periods beneited Depreciaion is used to track the.

Declining book value of the asset and produces a decreasing. Depreciation is used to allocate the cost of the asset over periods benefited. The book value of an asset is.

All of the above are correct. Which of the following statements accurately describes depreciation. Depreciation has nothing to do with the value of the value of the asset.

Which of the following statements accurately describes the expression x-2x29. Depreciation is the process of allocating the cost of the asset over periods benefited. The original cost of an asset.

Course Title MGT 230. The book value of an asset is its original cost less accumulated depreciation. Two of the above are correct.

899ich ofe following statements accurately describes depreciationn. Which of the following statements accurately describes depreciation. Depreciation is used to track the fair value of the asset.

Or separate accounts for each body corporate. Two of the above are correct. Pages 154 Ratings 78 41 32 out of 41 people found this document helpful.

The book alue of an asset is its original cost less accumulated depreciation and Band nd Which one of he following regarding the uet book value of an asset is. Two of the above are correct. Depreciation is used to track the fair value of the asset.

Pages 18 Ratings 100 1 1 out of 1 people found this document helpful. Depreciation is used to allocate the cost of the asset over periods benefited. The book value of an asset is its original cost less accumulated depreciation.

Which of the following statements accurately describes the distribution of the.

Solved True Or False New Technology Shifts The Production Chegg Com

Quiz Worksheet Calculating Depreciation Expense Study Com

Straight Line Depreciation Formula Guide To Calculate Depreciation

Solved Which Of The Following Statements Accurately Chegg Com

No comments for "Which of the Following Statements Accurately Describes Depreciation"

Post a Comment